Insights from across our industries, professions & regions

It’s our business to keep informed about the complex and interconnected challenges facing organisations and professionals across the major value chains.

The aim of our content is to share unique and valuable perspectives from across our network, to help you overcome barriers to innovation and highlight examples of individuals who are leading the way in their industries, professions and regions.

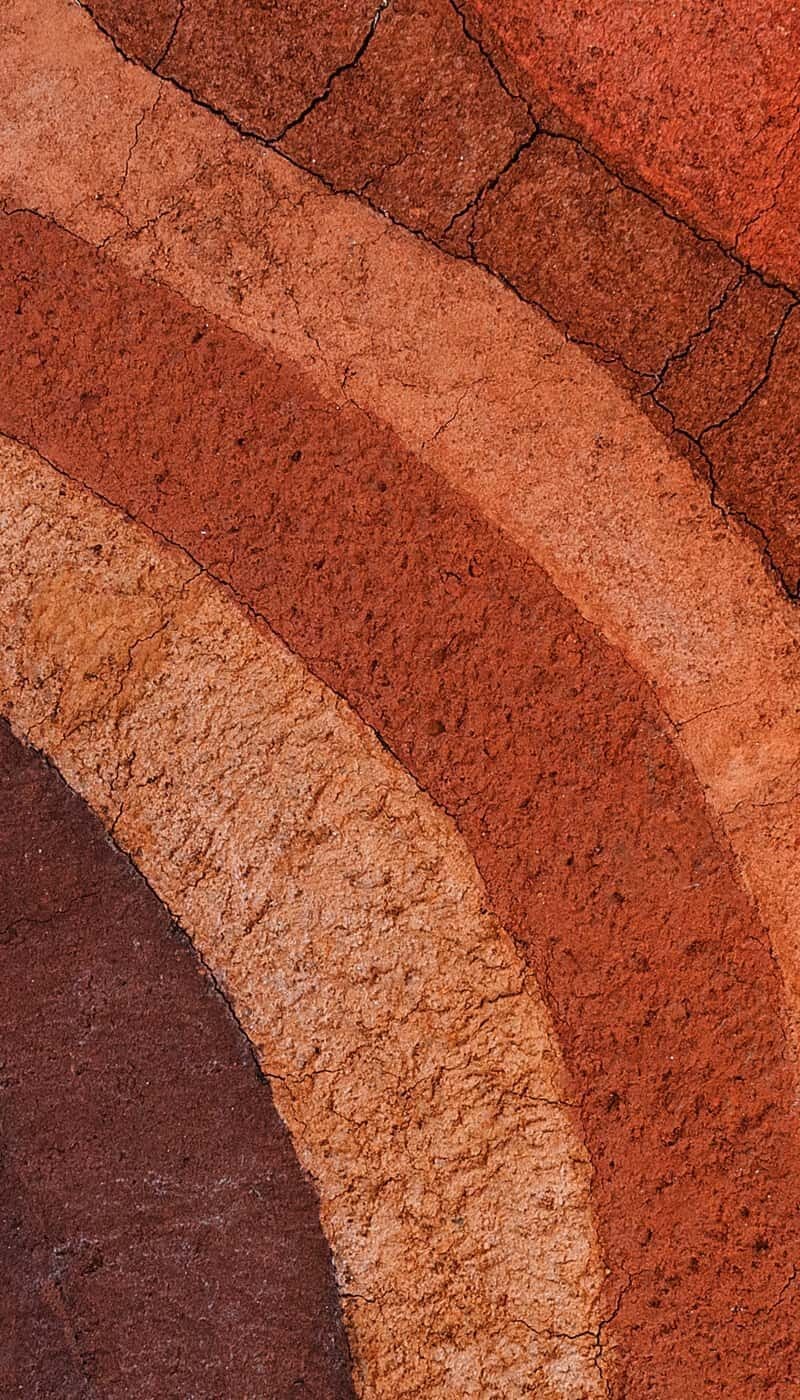

Breaking Barriers to Sustainability

Leaders across our markets face growing complexity, aligning commercial and sustainability goals, creating solutions that drive sustainable performance and success.

We’re sharing unique and valuable perspectives from across our network, focused on breaking down barriers to sustainability and showcasing those leading the way.

Proco Group

Home to Proco Group news and updates, from the latest hires to career stories and more

Sustainability

Paving the way forward in sustainability

Trading and Analytics

Analysing, monitoring and forecasting trends are essential for companies operating across commodity, industrial and commercial markets.

Technology

Senior leaders across commodity, industrial and consumer markets must navigate the complexities of technology to adapt to change and command a competitive position.

Finance and Risk

Building supply chain resilience with financial and risk management.

Legal and Compliance

Regulatory compliance is complex and failure to comply has wide-ranging consequences.

Procurement

Navigate the complexities of procurement to stay competitive and adapt to change.

Supply Chain Management

Senior leaders across commodity, industrial and consumer markets must navigate the complexities of supply chain management (SCM) and adapt to change to compete effectively.